Don’t Risk your Money on Pyramid Schemes!

Sachini D. Perera

In difficult times like these when income and work are threatened due to the pandemic, people are unable to survive without money. So they try out different businesses and options available to them using certain products or services. However, this game of survival sometimes runs out of morality – scams. Most of us can fall for ‘get-rich-quick’ schemes. These scams come to your doorstep through colleagues or friends, so you cannot figure out scams on the first impression unless you have awareness about its nature, how it fools people and why people fall into debt due to this financial fraud.

Pyramid business marketing is also known as ‘pyramid selling’, ‘network marketing’ or ‘referral marketing.’ It follows the principle of ‘beggar your neighbour’. Under Section 80(E) of the Banking Act No. 30 of 1988, the pyramid business marketing schemes are illegal in Sri Lanka. Further, local and international level financial transactions which happen using pyramid schemes are already severely banned under the Provisions of the Exchange Control Act and the Prevention of Money Laundering Act. No one is allowed to commence, continue or handle such a type of illegal business directly or in other ways, to suggest pyramid businesses to other individuals, to promote or market the pyramid business plan, to command others on its business tasks or to allocate money on pyramid business. If a person is accused of having connections to the pyramid scheme, the convict will be imprisoned for up to 3 years, be ordered to pay a fine of Rs. 1 million, or both.

There are several on-going pyramid businesses which still continue suspended by the legal mechanisms inside the country. Among those are Global Lifestyle Lanka, QNet, Oriflame, Golden Key, GramFree, etc. This illegal and aggressive business practice recruits people by making them purchase a product package. It also promises to give back a certain percentage of shares and high rewards in a short period if the customer enrols multiple subsequent members. Newcomers to the scheme indirectly afford extraordinary advantages for the rooftop investors of the business. Eventually, the business drains financially, leaving nothing behind. This is how the referral system of this business works, according to Dr Aluthge, senior lecturer of the Department of Economics at the University of Colombo.

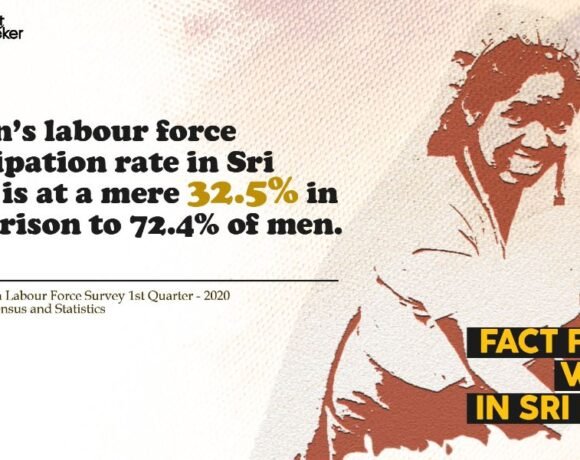

The target social groups of these kinds of expanded frauds are midwives, military wives, housewives, pensioners, differently-abled people, university students and small scale self-employers who are financially bankrupt and are eager to earn quickly. During the COVID-19 pandemic, pyramid schemes arose once again in Sri Lanka with a considerable potential to manipulate the money of innocent people. Although the Central Bank of Sri Lanka is still cautioning people and holding awareness programmes about this scam network, people still get fooled and think of it as an easy way to earn. Because of this ‘beggar your neighbour’ earning system, pyramid schemes have pushed their customers into debt.

According to the Central Bank of Sri Lanka, pyramid marketing agents use to sell a few categories of products such as medical products and accessories, gold coins, beauty cosmetics, home items, electronics etc. People purchase these products which have no definite market not because they are necessary but with the intention of accelerating their personal revenues. This scam doesn’t even keep historical records of their profit columns in order to dismiss customer complaints or the ability to track back to the top-level investors. While Sri Lanka is ranked highly (number 2) as a consumer behaving country in the banking sector out of all developing nations, we still see the vacuole of why this cannot be abolished, stated Dr Aluthge.

Social media platforms have a major influence by fueling pyramid business plans because of this type of media at our fingertips. In addition, the customer should have digital literacy and financial literacy skills to figure out these scams and get rid of it. Pyramid scheme is somewhat a current threat of a forthcoming capitalistic economy in Sri Lanka and an everlasting controversy in the division of income, explained Dr Aluthge.

The infrastructural aspects of society in Sri Lanka need to strengthen using more awareness campaigns regarding pyramid business schemes. What’s more, people should possess some form of financial literacy in order to overcome these potential pitfalls on their journey as breadwinners for their families. Regulating and implementing legal actors are still beneath the visible level. The expertise of the labour force should be augmented to monitor the structural problems of our socio-economic dynamics. Or else, only the fittest will survive, directing the rest of us to a financial tomb.